Global remittances and payments — a use case for crypto and the Bulla protocol

I was reading Murtaza Hussain’s article regarding growing use of crypto in remittances.

A Billion Here, a Billion There: Crypto Remittances Are Suddenly Real Money • 1729

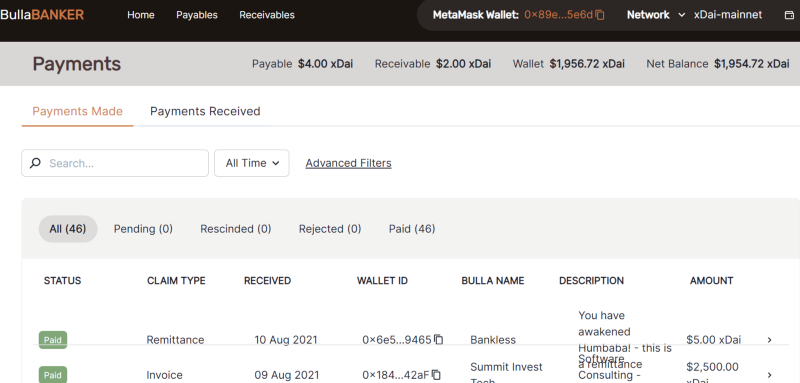

Bullabanker can manage remittances for any wallet. The use case for a migrant worker would be to stay organized and perhaps remain compliant.

Compliance aside, the appeal to better organization may be lost — as most are probably remitting to the same address(es) — and so their needs are simple and the most simple remittance is a direct crypto send.

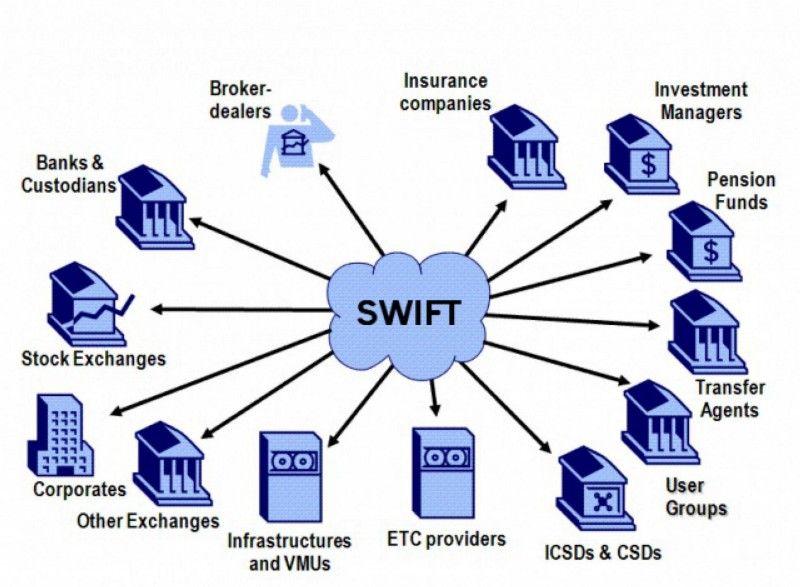

But besides a migrant worker sending home money, there is our current global world of business payments to consider.

I use a great technology firm in India. They will send me an invoice in US dollars. That is the easy part. It is often that this firm will email later and ask if I have sent any money. (which I have and show them an ACH snapshot)

I tell them that I sent a wire at least a week ago.

I could just send them an crypto : xDai, BTC, ETH etc.

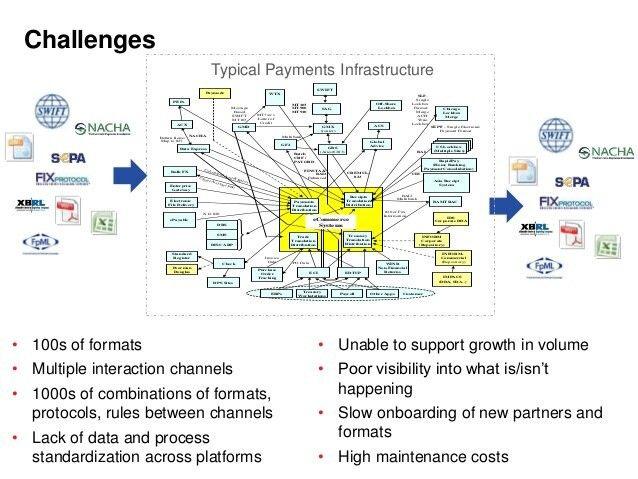

If there is a problem with doing the above — it would be for my business organization and ultimately, easy government tax compliance.

On the business side, I will have a mass of transactions I need to sort out and link to invoices or remittances. There will be operational steps I need to add to my accounting to manage direct payments to my contractors.

Fortunately, BullaBanker can invoice or remit to any address and it can include an IPFS of that invoice/remittance. If I organize my bullas properly, I can keep a current and projected profit and loss overview for any logical business unit.

The case for using BullaBanker is certainly for business operations.

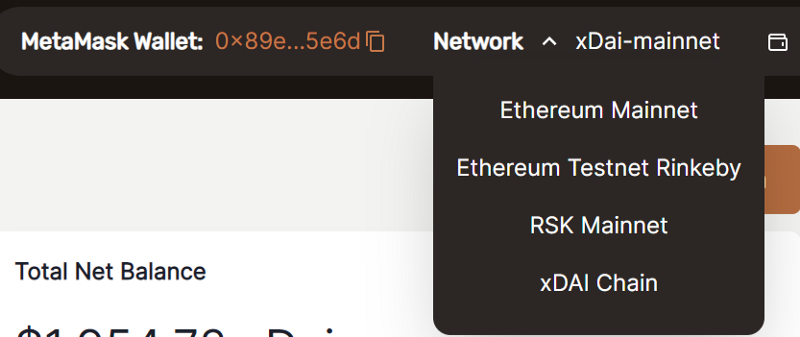

BullaBanker can change chains (with more to come). It could offer some accounting for BTC remittances via the RSK side chain. This requires a few hurdles bridging BTC to rBTc and the hope is such a bridge will become less clumsy.

Besides El Salvador, other countries could explore crypto and remittances. Here is another article I stumbled upon.

Add to this some data I got from world bank and this could be a next frontier for the world economy.

Personal remittances, received (% of GDP) | Data (worldbank.org)

I spoke with my Indian contractors and there were other hurdles to them using BullaBanker to invoice me. These were centered on compliance with their governments.

The case for using BullaBanker protocol could be jurisdictional compliance.

If a government requires payments to be documented — or some portion of these payments to be withheld, a BullaBanker token could include these rules for accepting payment.

It reminded me of another conversation I had with a person in Denmark. Here the emphasis was on VAT compliance. Again, a contingent claims protocol could easily include VAT collection or tabulation. You simply send an invoice, attach it to whatever specialized BullaBanker token your local environment requires and you are in compliance.

It brings me to a distinction that is getting lost. The distinction is crypto, protocol and digital currency. I have read that new digital currencies could include what I would call a large amount of protocol. The inclusion of protocol in digital currencies is designed for compliance and control.

I believe protocol nuance is superior to specialized digital currency. The ‘edges’ of the crypto universe are what is relevant.

A claims protocol governed by a DAO or a series of linked DAOs purposed for local compliance is sufficiently dynamic to resolve global payments issues and compliance. (A benefit might also be a greater awareness of the externalities of government rules and regs. I can hope — right?)

A jurisdiction should be the final parameter(s) to a general protocol for payments. The crypto should be the ‘rail’ to greater global collaboration. A digital currency containing too much protocol could ‘silo’ payment ease at too ‘high’ a level and inhibit business. I feel it could suffer a sort of Laffer curve problem and so foster less compliance.