Rare opportunity

Bulla Finance is excited to launch a liquidity pool product that, together with partner TCS Blockchain, enables onchain freight settlement and offers leading-edge investment opportunities.

Depositors in the pool benefit from rare access to the low-risk high-returns and short tenor of the commercial paper market as well as the opportunity to earn yield on stable tokens.

The Bulla Liquidity Pool product allows accredited sources to gain short term yields that are 2-3 times higher than U.S. Treasury rates, secured against commercial paper assets (freight invoices) purchased and collected by TCS Blockchain.

The pools are private for sources and allocators and can be fully customized. For example, available only for “N30 freight invoices,” or only “Fortune 1000 Debtors (AAA).”

How it works

Bulla Finance uses the Bulla Network protocol to tokenize invoices and claims as input to liquidity pools.

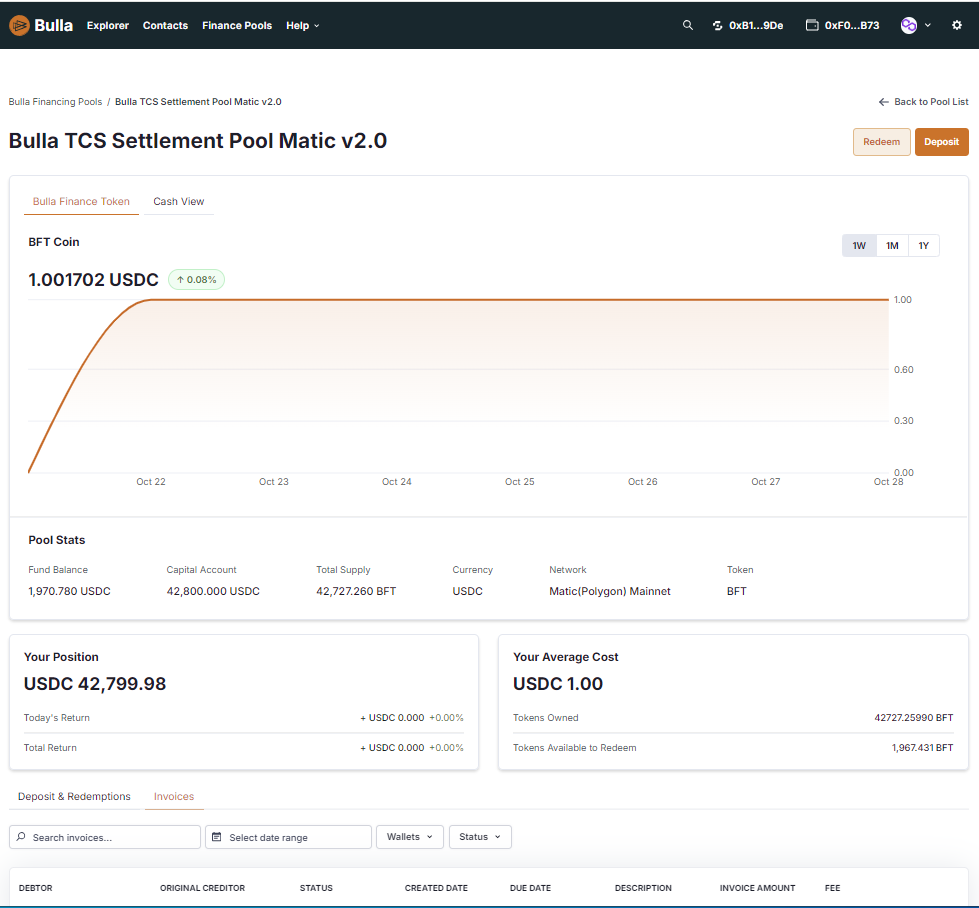

Our initial offering, the Bulla TCS Settlement Pool, provides liquidity for the transportation industry through our partner TCS Blockchain and is backed by AA/AAA commercial paper. Participation in the Bulla TCS Settlement Pool is turnkey and offers fast onboarding.

As described above, Bulla also offers Custom Liquidity Pools for interested investors. Custom pools can be set up with our team to maximize flexibility, liquidity and investment goals.

Management and purpose

All pools are created and managed by the Bulla and TCS Blockchain in-house finance team. They provide mission-critical credit to the North American transportation industry.

The size of the current North American factoring market is approx. $2T.

Learn more about how TCS Blockchain settles freight here.

Going forward, Bulla will leverage this functionality for other sectors, including manufacturing, healthcare, construction, staffing and a range of service industries.

Bulla Network, an on-chain credit protocol, has added this feature to its core offerings to help web3 businesses and digital-first investors to grow their portfolios, scale operations and manage their finances.

At Bulla, we believe in an efficient and transparent financial system, and our tools are built to help eliminate exclusivity in liquidity provision and enable a self-sovereign banking ecosystem.

Please join our waitlist to get updates and early access.

USE CASE: TCS Blockchain

TCS Blockchain is the world’s first and only blockchain alternative to freight invoice factoring – dedicated to lowering the cost of settlement up to 90 percent for transportation companies. TCS will use the Bulla Network protocol plus a Bulla Finance Lending Pool to enhance liquidity for more than 400 trucking companies.

HOW IT WORKS

Bulla’s protocol enables TCS to tokenize invoices related to any bill of lading (BOL). TCS can then offer these tokens for AR finance to the Bulla Finance pool. The pool funds these tokenized invoices at a discount and waits for invoices to be paid. Insurance companies and other institutions holding USDC can earn a fee and deposit or redeem from the lending pool.

VALUE PROPOSITION

This is the first known uncollateralized provision of short-term liquidity for businesses and solopreneurs that is completely on-chain. This integration leverages all of the advantages of the blockchain: It streamlines the loan process, improves auditability, increases transparency and lowers costs.