Introducing the Bulla Finance Lending Pool – a vision realized!

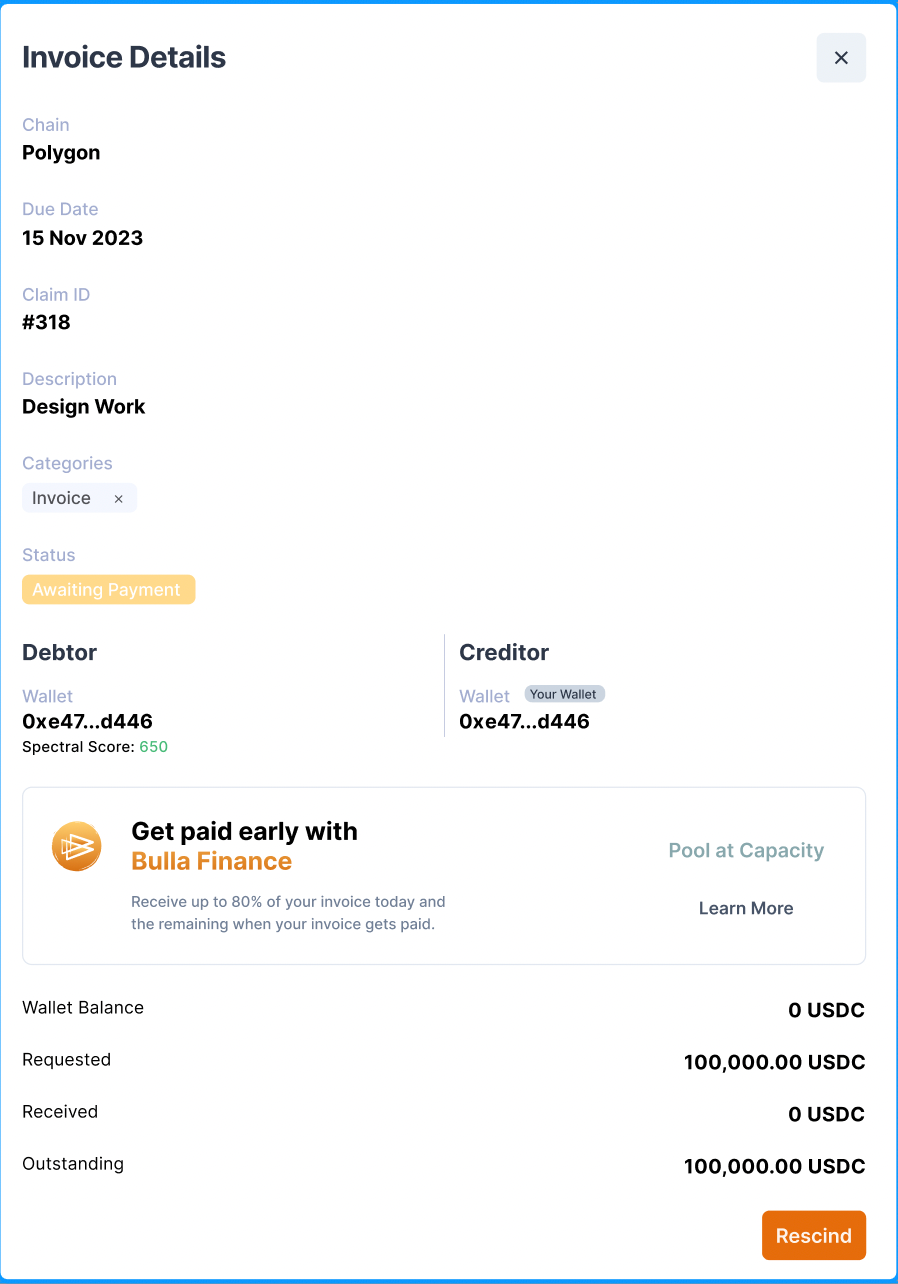

We’re thrilled to announce Bulla Finance – a new feature of our invoicing dApp that is now in beta. Once you create an invoice, you will see a “Get paid early with Bulla Finance” button in the middle:

This feature might look small, but it represents a major revolution in the world of onchain finance – the advent of inclusive, bankless, credit creation. Through Bulla Finance, it is now possible for companies to raise capital and for accredited investors to finance projects and businesses completely onchain – banklessly and seamlessly – through the Bulla Finance Lending Pool.

At first, we are using the pool to provide front-end liquidity to our partner, TCS, an onchain settlement service for the transportation industry. We anticipate that we will soon be able to offer the feature to a wide range of other users interested in factoring invoices and financing commercial paper. (To participate in this exciting offer, join our waitlist HERE)

And while this is revolutionary for the world of financing, even more, it represents a monumental achievement on a personal level that goes back to the reasons I founded Bulla.

I started building Bulla with the purpose of decentralizing banking and credit provision. September 2008 was a watershed moment, and not only because I was a Lehman Brothers casualty. Once the dust settled on that crisis, it was obvious that banking and the provision of credit had been overtaken by various actors. Unfortunately, the system's flaws and incentives forced a sort of socialized risk and privatized profit solution that I think was never the aim of those in charge or, let me be kind, most of them.

I later discovered the blockchain and started to believe that it could facilitate banking and credit with fewer opportunities for any one group to ‘game’ things as spectacularly as had been done in 2008.

A blockchain’s first purpose is to be the source of truth of – and to secure control of property. Ownership and control of property are the fundamental elements that allow people to benefit from their work. But simply securing ownership does little to facilitate business. World economies also need credit. It is here that I think the blockchain will have a large impact on standards of living.

Bulla lets me express (or own) my future (or performed) work on a blockchain. An invoice is a physical representation of this. Others who understand the value of my work may choose to offer me financing on this invoice. Executed on-chain, the idea is simple. I mint a claim that I can (or have) produce(d) X for some amount of tokens. If people see my signature to a claim - and know the history of my claims, the rest follows.

When we can express simple credits (in an immutable way), we can begin to build simple credit provision. Lending pools can accept claims and finance these. There are many incentives to financing credit on-chain and in a pool. I offer a few below:

- Transparency - a pool can list all claims and their state of repayment.

- A pool can target a rate of return and can buy/sell its own token to reduce or increase its ‘dry powder.’

- The depositors in the pool can set a underwriter logic and members can be publicly scored vs the target rate.

- The financing people in a pool can join pools best suited to their credit needs and expertise.

- The leverage in a pool is always known. There can be no re-hypothecation within a pool.

- A creditor to a pool can attempt to mint spurious claims but this risks his ‘signature’ and future access to capital.

- A pool can not be ‘frozen’ by anyone due to some other mismatched off balance sheet liability - ever.

- The minimal Azure/AWS infrastructure the Bulla dApp uses could be shutdown or inhibited, but the contracts are deployed - it is unstoppable.

- Infrastructure in point 8 may be addressed with an IPFS deploy, but Bulla still thinks the positives of crypto will outweigh the current ‘Fud’. Time will tell. We are watching.

I want to stress that these are simple credits. These are the most ‘organic’ forms of credit. It emanates from myself or my business. I am not talking about ‘top down’ tokenizations of larger more complex objects performed by some reputable tokenizing agent for you. You originate these credits using Bulla and your signature. In fact, the word “bulla” is actually an ancient Sumerian term, meaning stamp or signature.

Something else that needs to be said is that I don’t think there should be outsized fear of the traditional banking system. This system has its purpose and will not go away. To add to the bearish crypto argument - crypto credit vs traditional is still uncompetitive. But crypto credit will grow.

My expectation is that the blockchain can become competitive and eventually improve the quality of credit returns for investors as well as provide better-priced finance to businesses.

It has started with freight, but it will not end there. I have designs to offer general consumer credit and supply finance. Imagine a consumer finance DAO where the rate of credit to consumers is governed by their collective repayment actions, a token governed underwriter logic and a drive to constantly offer the lowest cost to consumers at better risk adjusted returns to investors? This could really be game-changing!

And there are countless other applications. They all center on the true nature of blockchains - a source of truth - to ownership and, with Bulla, to simple credit claims and their finance.